Welcome to Westpac Choice

Get up and running

Download the Westpac App to explore exclusive Westpac-only discounts, cashbacks, and deals.

Regularly check in so you don’t miss out

With an ever-expanding list of offers, here’s a taste of some of the big brands you’ll find on the Rewards & Offers Hub:

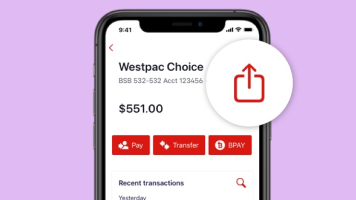

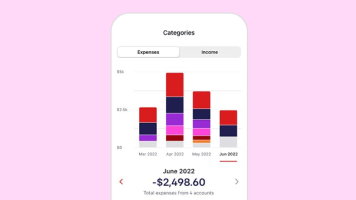

Let’s get you banking anywhere, anytime

Got your Digital Card? Use the Westpac App to manage your Westpac Choice account on the go.

What else can I manage online?

Give them a head start with their own Debit Card

Children 8 years old and over can link a Debit Mastercard® to their Westpac Choice everyday account, fast-tracking their money skills with kid-friendly features, keeping them safe and secure:

Weekly spend limit

So they don't spend all their money at once, changing the limit as they get more experienced.

Card lock and unlock

Keeps their money safe if they’ve lost, misplaced or had their Debit Card stolen.

Kid rated shopping

Children can shop confidently in-store or online without the fear of spending at adult-only sites or retailers.

Parental notifications

Messages for parents or guardians about their account activity so you can guide and support your child.

Get more with Westpac

Things you should know

Who can apply for a Debit Mastercard?

Read the Apple Pay Terms and Conditions (PDF 42KB) before making a decision and consider if it is right for you. To use Apple Pay you will need an eligible card and a compatible device with a supported operating system. See our Apple Pay FAQs for more information. Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

The Westpac App is only available for use by Westpac Australia customers.

Android, Google Play and the Google Play logo are trademarks of Google LLC.