SET YOURSELF INTEREST-FREE

Flex Card is a simple, affordable and interest-free card that makes it easy to pay for the unexpected as well as the things you want. And, best of all, it’s accepted everywhere – both in-store and online.

0% interest

$1,000 credit limit

$10 monthly fee, or no outstanding balance, $0 fee

$0 late payment fees

New cards only. Available for existing Westpac customers.

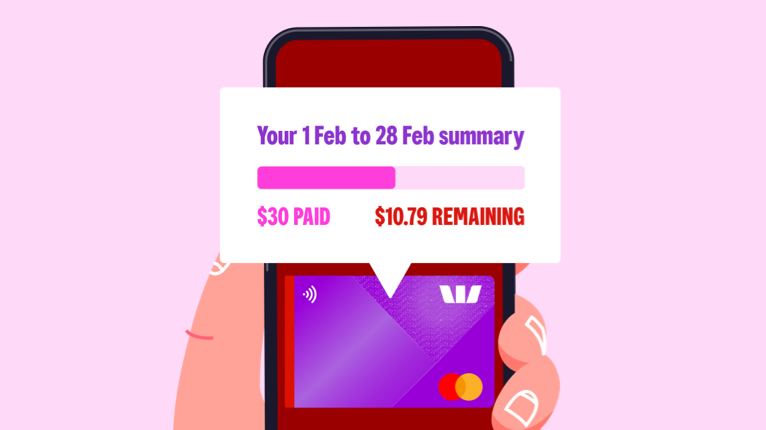

When you’ll be charged the monthly fee

A flat $10 fee will only be charged at the end of the month if you have not paid your outstanding balance on your previous statement in full by the due date.

What else you’ll love

- Accepted everywhere.

- Apply and start spending in minutes.

- Choose to repay monthly or twice a month, plus pay back more at any time.

- Enjoy fraud protection.

- Access to Westpac Extras and Rewards.

- Minimum monthly repayment of $40.

- Did we mention 0% interest and $0 late payment fees?

How Flex Card works

Keeping your details, account and money safe

Digital CVC

A 3-digit security number (CVC) that refreshes every 24 hours to help keep your details safe.

Fraud Money Back Guarantee

If you didn’t contribute to the loss and contact us straight away, you’ll be reimbursed for unauthorised transactions.

Westpac Protect™ SMS Code

An optional extra layer of protection to authorise certain transactions.

Westpac Extras & Rewards

With Flex Card you don’t need an excuse to reward yourself.

Earn bonus Cashback

Westpac Extras

Regularly updated cashback offers for in-store and online shopping with some of your favourite brands.

Rewards and Offers Hub

Brings you deals and offers just for being a cardholder. Sign into Online Banking or the Westpac App to explore your offers.

Take control of your money within the Westpac App

Powerful money management tools in the palm of your hand.

Get spend and cash flow insights

Track your month-to-month Cash flow and spot areas where you could be making savings with your spend sorted in Categories.

Manage your cards in one place

Order a new card, change your pin or temporarily lock your card if you misplace it, all in the app’s convenient Cards Hub.

View and transfer funds fast

Quick Balance lets you view the balance of three main accounts and quickly transfer money without signing in.

Introducing Westpac Flex card

Before you apply

A few pointers to improve the likelihood your application is approved.

- You're aged 18 or over.

- You're an Australian citizen or permanent resident.

- You have a regular, verifiable Australian income from the same source for at least 3 months

- You have a fixed residential address in Australia

- You have an eligible Australian bank account

- You’re up-to-date with all your regular payments (rent, phone, other credit cards or loans including afterpay etc.)

- You haven’t made another application for Flex in the last 90 days.

FAQs

To complete our credit assessment, we require access to your everyday transaction account records (where you have your regular income deposited and you use for your spending). If this account is held with another bank, our secure service allows you to connect to your other bank for a one-time check of your transaction and income history.

We will access your transactions for the last 12 months for assessment purposes and retain the key decision details, such as your total income and expenses. We do not have access to, or retain, your account details. It's fast, secure, and document-free.

Things you should know

Credit criteria, fees and charges apply. Credit Card Product Switches, upgrades or Westpac group staff are ineligible.

Be credit savvy: Before applying, consider the credit limit and check all conditions, fees and charges on your selected card.

Monthly fee waiver: Flex Card has a flat Monthly Fee. The Monthly Fee is charged to your Flex Card Account each month and once it is charged it forms part of your balance. This Monthly Fee will, subject to the Flex Card Terms and Conditions, be waived if you pay off the Closing Balance shown on your previous statement by the payment due date shown on your statement.

Read the Apple Pay Terms and Conditions (PDF 42KB) before making a decision and consider if it is right for you. To use Apple Pay you will need an eligible card and a compatible device with a supported operating system. See our Apple Pay FAQs for more information. Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.