Spending and saving accounts for high school starters

Under 18? Get $30 on us.

Never had a Bump Savings or Choice Account?

Get one of each then deposit at least $100 into your savings within 30 days - and we'll give you $30.

T&Cs apply.

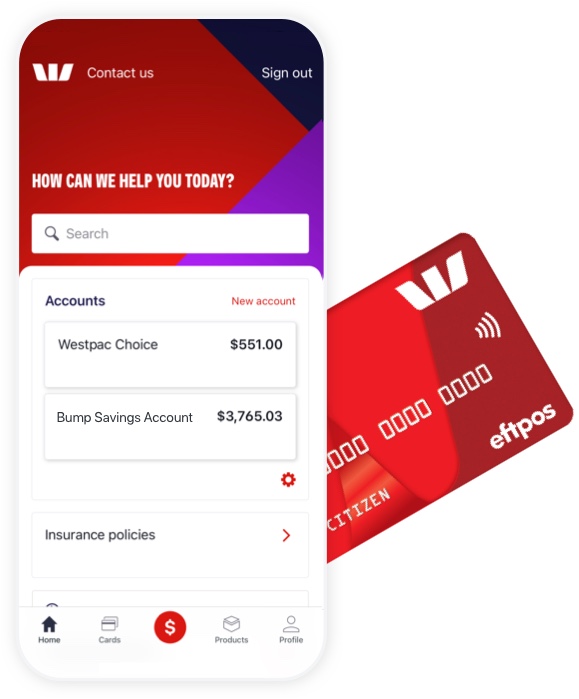

Get a helping hand with your spending and saving

- Learn smarter spending

Shop in stores and get cash out with a Westpac Debit Mastercard @1. There’s also an optional Parental Control 2 feature in Online Banking 3, to help keep a look out on your spending and saving.

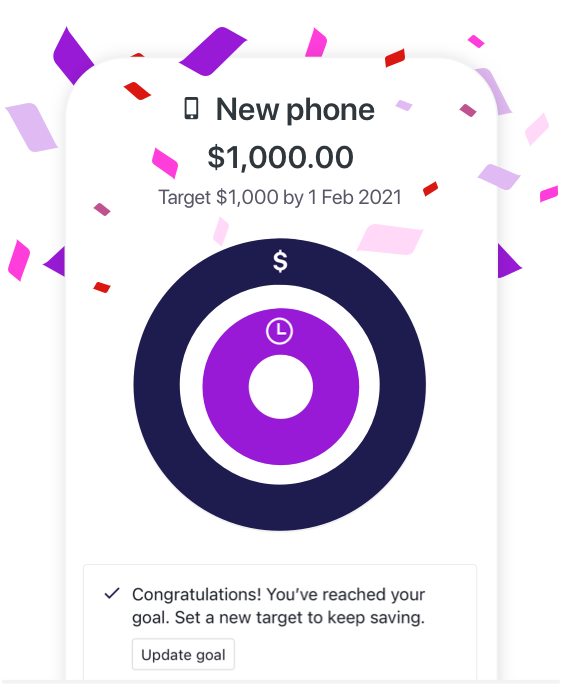

- Set your own Savings Goals

Saving for more than one thing? You can set up to six savings goals 4 in your Online Banking with just the one account and track them using our app on your phone. You’ll also earn bonus interest 5 each month you grow your balance.

- Keep your money safe

Keep tabs on your money anytime with our secure banking app that also lets you lock your Debit Mastercard or report it lost if you can’t find it 6. Your money is protected with our Fraud Money Back Guarantee 7.

$0 Account-Keeping Fee

There may be other fees and charges that apply in some circumstances – Please refer to the Terms and Conditions (PDF 621KB)

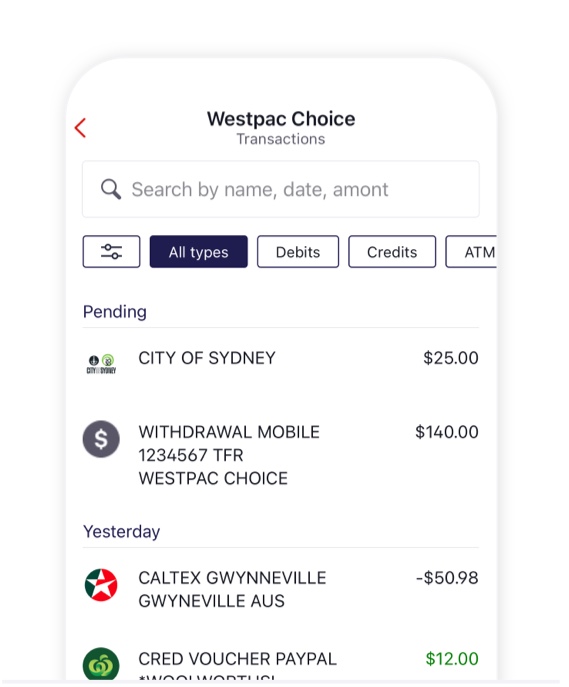

Banking made easy

Accessing your money

A good spending account should offer you easy ways of accessing your money when you need it. As well as your Debit Mastercard, you can use Cardless Cash9 to get cash out with just your mobile phone at any Westpac Group ATM10. If you’ve set up Parental Control, they’ll also be able to view and transfer money to your accounts in Online Banking or with our app.

Make saving simple

Getting into good savings habits when you’re young can help set you up with good money skills for life. A Westpac Bump savings account can also give your savings a boost by paying you bonus interest when you grow your savings monthly. You can make it easy on yourself by putting your savings on autopilot with an automatic transfer from your spending account to your savings account.

Earn up to 5.00% p.a. variable interest rates

- 2.00% p.a. variable base interest rate

- 3% p.a. variable bonus rate when you grow your balance every month

How to get started

What ID do you need?

So we can keep your money safe, we’ll need to check some of your ID before you can start using your account. The easiest way to do this is to head into a Westpac branch with your ID. This can include the following:

- Australian birth certificate

- Passport

- Medicare

| Fees | |

|---|---|

| Westpac Bump savings account | $0 |

| Westpac Choice bank account | $0 (Account-Keeping Fee waived for under 30s) |

|

This fee is waived for:

|

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 621KB)

Financial Literacy for Kids & Teens

We're here to help teach kids and teens how to better manage their money.

Smart money articles

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

1.Debit Mastercard®: holders need to be at least 8 years of age and have an Australian residential address to be eligible for the card.

Mastercard® is a registered trademark of Mastercard International Incorporated.

2. Parental Control: Parents, grandparents, or guardians must be an account signatory to have Parental Control. There is a limit of two signatories per Bump Savings account. Child must be registered for Westpac Online Banking and Westpac Telephone Banking to access accounts online or over the phone. For children under 14 years of age: Parental Control is mandatory, and self-service Telephone Banking is not available. For children aged 14 years and over: Parental Control is optional and access levels can be amended by the child at any time. Parental Control does not apply to a child’s access to funds in branch, however a signatory must authorise branch withdrawals where a child is under 8 and a debit card is not available.

3. Safe Online Banking guarantee: ensures that customers will be reimbursed for any unauthorised transactions provided that the customer has not contributed to the loss and contacted Westpac promptly. Refer to the Westpac Online Banking Terms and Conditions (PDF 417KB) for full details, including when a customer will be liable.

4. Savings Goals: Both an account holder and an account signatory (where applicable) can use the Savings Goals feature, including to view, add, edit and delete the savings goals on a Bump Savings or Westpac Life account.

5. Bonus interest: You will be eligible for bonus interest if during the month (subject to transaction processing times):

a. your account balance has not fallen below $0; and

b. you (or someone on your behalf) have made a deposit of any amount; and

c. the account balance on the last business day of the month is higher than the account balance on the last business day of the previous month.

Interest paid into your account does not qualify as a deposit in terms of bonus interest eligibility.

6. Card on hold: Available on personal credit and Mastercard® debit cards only. Cards to which a temporary lock can be applied will be listed when you sign in to Mobile Banking or Online Banking and visit Lock a card temporarily under Cards services.

7.Westpac Fraud Money Back Guarantee: Customers will be reimbursed for any unauthorised transactions provided that the customer has not contributed to the loss and contacted Westpac promptly.

8. Westpac everyday account: To open a Westpac Life or Bump account, customers must hold a Westpac everyday account in the same name and be registered for Online and Phone Banking. Fees and charges may apply on the everyday account.

9. Cardless cash: is available on eligible Westpac transaction accounts with a linked debit card. Get Cash limit of 3 withdrawals per day applies, subject to $500 daily withdrawal limit and $1,000 weekly withdrawal limit. Only available at Westpac Group ATMs in Australia. To access cardless cash on your mobile you must be registered to use Westpac Online Banking and download the Westpac Mobile Banking App. To use Westpac Mobile Banking on Apple Watch you’ll need to pair your Apple Watch with an iPhone 5 or above with iOS 8.2 or above. You’ll also need the Westpac Mobile Banking app (version 6.1 or above) installed on your iPhone.

10. Global ATM: A 3% Westpac Foreign Transaction Fee applies to overseas debit card withdrawals. A list of Global Alliance members is available. To ensure access to savings and/or cheque account funds when overseas obtain a Debit Mastercard®.

Financial Claims Scheme: payments under the FCS are subject to a limit for each depositor. For more information visit www.fcs.gov.au.

.jpg)