SHOP SAFER AND SMARTER WITH A WESTPAC DIGI CARD

Digi Card is a digital version of a Westpac Choice debit card that can be used instead of a physical card. You can use it to shop safely online, pay bills, make in-app purchases and set up recurring card payments – you can even add it to your mobile or wearable wallet to shop in-store.

Not only is it super convenient, it’s one of the safest ways to shop as well:

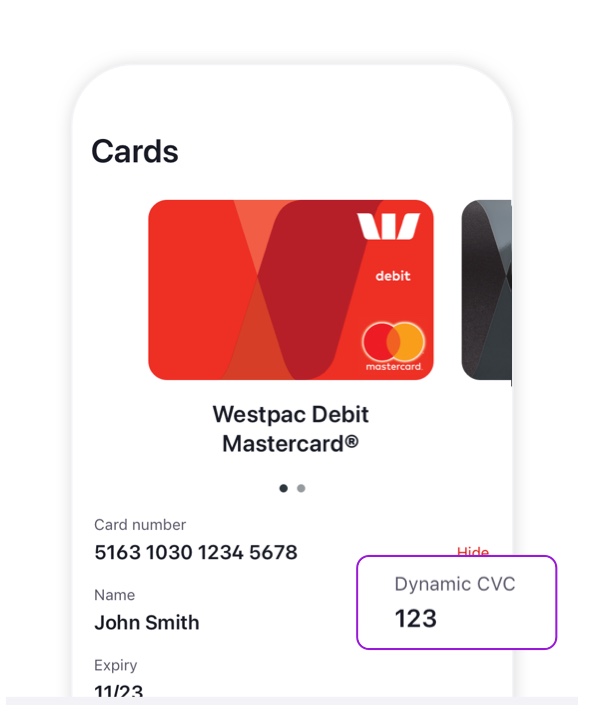

- Shop safely and securely

Your Digi Card’s CVC (the 3-digit number on the back of your card) updates every 24 hours, making it one of the safest ways to shop online.

- Save time online

No need to have your wallet or card nearby as your card details are already stored directly in the Westpac App.

- Breathe easy knowing your money is safe

Shop securely with your debit card. We’ve got your back with 24/7 fraud monitoring and our Fraud Money Back Guarantee. 1

You can also pay with

Save a little when you spend with Westpac Choice

We’ve partnered with some major brands to provide you with savings across entertainment, fashion, your everyday shopping, and more. Once you’ve signed up, you can search ‘rewards’ in the app to see what is on offer. *

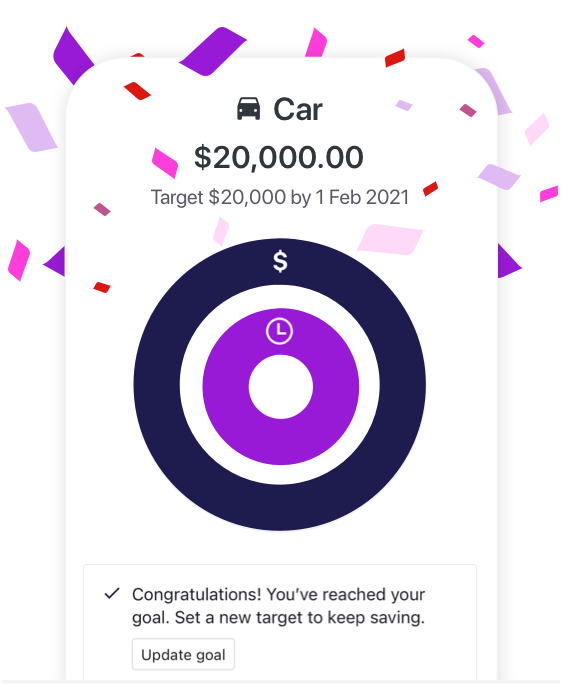

Combine with a Life Savings account and reach your goals sooner

- Give your savings an easy boost

You’ll get a base rate for total savings balance, plus a bonus rate everytime you grow your savings.

- Set up to 6 savings goals

Saving for more than one thing? With our handy Savings Goals feature 2 you can bucket your savings into up to 6 different goals with just the one account.

Fees

| Standard fees (fees may change) | Amount |

|---|---|

Monthly service fee |

$5 |

|

This fee is waived for:

|

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 621KB)

Things you should know

Deposit Accounts for Personal & SMSF customers Terms and Conditions (PDF 621KB)

Westpac Debit Mastercard® Terms and Conditions (PDF 204KB)

Online Banking Terms and Conditions (PDF 417KB)

Find out what information you need to provide to become a customer (PDF 657KB)

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

Debit Mastercard®: holders need to be at least 8 years of age and have an Australian residential address to be eligible for the card.

* Partner offers are subject to Terms and Conditions and may be varied or change at any time. Images are shown for illustrative purposes only.

1. Westpac Fraud Money Back Guarantee: ensures that customers will be reimbursed for any unauthorised transactions, provided that the customer has not contributed to the loss and contacted Westpac promptly. Refer to the Westpac Debit Mastercard Terms and Conditions for full details, including when a customer will be liable.

2. Savings Goals: Both an account holder and an authorised user can use the Savings Goals feature, including to view, add, edit and delete the savings goals on a Westpac Life account.

Westpac Life account: to open a Westpac Life account you need to be aged 18+ (if you’re under 18, check out our Bump savings account)

Westpac everyday account: To open a Westpac Life or Bump account, customers must hold a Westpac everyday account in the same name and be registered for Online and Phone Banking. Fees and charges may apply on the everyday account.

Digital Card: The Digital Card is only available in the Westpac App and supported with the latest version of the Westpac App. The terms and conditions applicable to your product also apply to the use of your digital card. Online Banking Terms & Conditions also apply. You may not always be able to access your digital card.

Please refer to the Digital Card page for more information and FAQs

Read the Apple Pay Terms and Conditions (PDF 42KB) before making a decision and consider if it is right for you. To use Apple Pay you will need an eligible card and a compatible device with a supported operating system. See our Apple Pay FAQs for more information. Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Read the Samsung Pay Terms and Conditions (PDF 63KB) before making a decision and consider if it is right for you. Available for eligible cards. To use Samsung Pay you will need to use a compatible phone with a supported operating system. Internet connection may be needed to make payments using Samsung Pay and normal mobile data charges apply.

Read the Google Pay Terms and Conditions (PDF 125KB) before making a decision and consider if it is right for you. Available for eligible cards. To use Google Pay you will need to use a compatible device with a supported operating system. Android, Google Pay and Google Play are trademarks of Google Inc

Fitbit and the Fitbit logo are trademarks or registered trademarks of Fitbit, Inc. in the U.S. and other countries.

Garmin, the Garmin logo, and the Garmin delta are trademarks of Garmin Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

A Debit Mastercard attached to a Westpac Choice account is required to use the Beem It app.

Beem It is a facility provided by Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 and made available through its authorised representative, Digital Wallet Pty Ltd ABN 93 624 272 475. Before downloading the app please consider the Product Disclosure Statement and Terms and Conditions, available at beemit.com.au. As this advice has been prepared without considering your objectives, financial situation or needs, you should, before acting on it, consider the facility's appropriateness to your circumstances. Before making a decision about any of our products or services, please read relevant terms and conditions available at westpac.com.au. Fees and charges apply and may change.

BPAY® and Osko® are registered trademarks of BPAY Pty Ltd ABN 69 079 137 518.