Introducing the Westpac Life® account

For the saver who spreadsheets

Earn extra when your savings grow.

The Westpac Life® account rewards savers with a variable interest rate of 5.00% p.a., which includes bonus interest every month you grow your balance1. Save, no matter what. Even if your balance doesn’t grow over the month, you’ll still earn a competitive variable interest rate of 2.00% p.a.

Manage the unexpected

You can dip into the Westpac Life® account and still earn a competitive base rate plus the opportunity to earn bonus interest₁

Flexible access

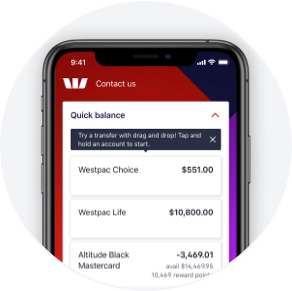

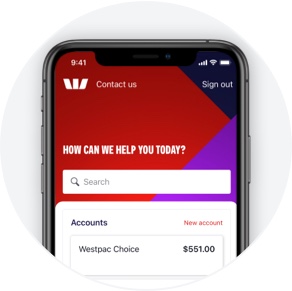

Get unlimited and instant access to your money online through your Westpac everyday account³ (if you don't have one, we'll open a Westpac Choice account for you)

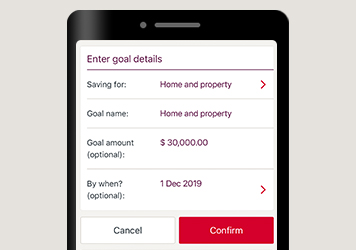

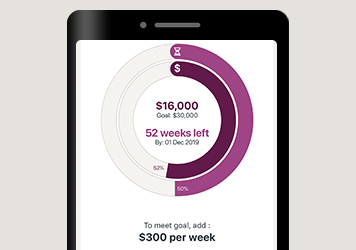

Savings Goals2 is a feature of Westpac Life designed to help make your dreams a reality. Here’s how.

Set up your goals and a regular transfer

Put your savings into autopilot by setting up an automatic transfer into your account. You can name your different goals, set the amount you’d like to save and when you’d like to save it by.

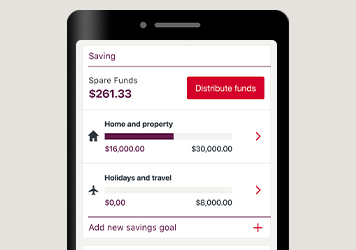

Make budgeting a breeze by bucketing your savings

Saving for a holiday and a rainy day? Set up savings goals for both within your Westpac Life account – no need to open multiple accounts.

Want to see how you’re tracking?

You can check in Online Banking and see how you’re doing. If your situation changes, you can edit and change your goals at any time.

Security

Safe Online Banking guarantee

If your Westpac account is compromised as a result of Internet fraud, we guarantee to repay any missing funds, providing you comply with our Online Banking Terms and Conditions4.

Protected under the Financial Claims Scheme

Westpac Life is a “protected account” under the Australian Government’s Financial Claims Scheme5.

Westpac Protect™ Security Code

Increase your Online Banking security by using your Security Code to confirm certain transactions via the Westpac App or SMS.

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

1. Bonus interest: Bonus interest of 3.00% p.a. variable is payable each month that you: make a deposit to the account, ensure the account balance is higher at the end than the beginning of the month, and keep the account balance above $0. For bonus interest qualification, a month is the period from close of business on the last business day of the prior month to close of business on the last business day of the current month. On the months you don’t earn bonus interest, you’ll earn the Westpac Life standard variable base rate.