You could earn better interest by opening a Westpac Life account

Earn up to 5.00% p.a. variable interest rate

2.00% p.a.

Standard variable base rate

plus

3.00% p.a.

Variable bonus rate each month you grow your balance1

Why open a Westpac Life account?

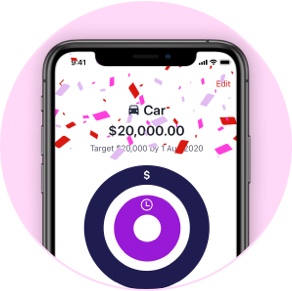

Savings Goals

Set up and track your personalised savings goals3 via Online Banking

Competitive base rate

Enjoy a competitive base rate on your savings

Ongoing bonus interest

You could earn bonus interest each month you grow your balance1

How Savings Goals work

Savings Goals3 is a handy feature of Westpac Life that lets you set up and track personalised savings goals via Online Banking.

With Savings Goals you can keep tabs on your progress and the savings calculations will show you how much to contribute regularly to help you stay on track.

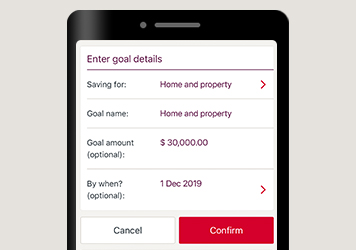

1. Setting up your savings goals

Set up to 6 different goals in the one account! You can change the savings amount, date and category across all of your goals and adjust them at any time.

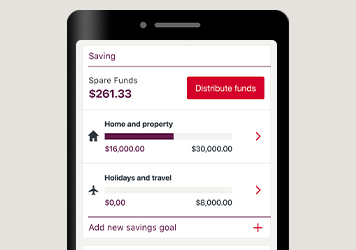

2. Adding to your savings goals

Each time you transfer money into your savings, you can distribute your amount across goals. Make it easier by setting up recurring transfers so the money automatically splits after pay day.

3. Tracking your progress

Tap on each of your savings goals to see how you're doing and how much you should be saving to make it in time.

Who is this account for?

Westpac Life is great if you want to:

- Save for different goals without the hassle of managing multiple accounts

- Earn a competitive interest rate even when you don't grow your balance

- Do most of your day-to-day banking online

| Total variable interest rate | Up to 5.00% p.a. |

|---|---|

| Standard variable base rate (when no standard variable bonus rate applies) | 2.00% p.a. |

| Standard variable bonus rate | 3.00% p.a. |

How do I earn bonus interest on my Westpac Life account?

Bonus interest is payable each month that you:

- Make a deposit to the account;

- Ensure your account balance is higher at the end than the beginning; and

- Keep your account balance above $0 at all times.

A month is the period from close of business on the last business day of the previous month to close of business on the last business day of the current month.

When is interest paid to my Westpac Life account?

Interest is paid on the last business day of each calendar month. Balances in your account on and after the last business day won't be included in the interest calculation for that month but will be included in the interest calculation for the following month. Balances include deposits made to your account.

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

a. your account balance has not fallen below $0; and

b. you (or someone on your behalf) have made a deposit of any amount; and

c. the account balance on the last business day of the month is higher than the account balance on the last business day of the previous month.

Interest paid into your account does not qualify as a deposit in terms of bonus interest eligibility.