New to Australia

Get started with a bank account today

Link your Choice account with a Westpac eSaver savings account

Enjoy a sweet, total introductory interest rate of up to 5.20% p.a on your savings for the first 5 months, giving you the breathing space to explore your new life in Australia.

Setting up life in Australia?

We've partnered with ShopBack to bring you Cashback offers on a wide variety of online stores across homewares, technology, food services, travel and more to make it easier for you to settle in.

Why choose a bank account with us?

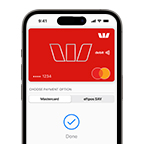

Apple Pay

Apple Pay offers a fast and secure way to pay in-store and online, using your favourite Apple device

Open your account up to 12 months after you've arrived

Pay no Account-Keeping Fee for the first 12 months

You’ll be with Australia’s first bank

We have 200 years’ experience helping customers create a new life in Australia

ATM network at home and overseas

Pay no withdrawal fee at any major bank ATM in Australia (including Westpac, Commonwealth Bank, ANZ, NAB, St.George, Bank of Melbourne and BankSA) and globally via the Global ATM Alliance and partner ATMs (other fees may apply)2

Transferring money

- Register for online banking and easily transfer money back to friends and family

- You can withdraw funds once you've completed an identity check when you arrive in Australia1

- Use our handy currency converter to see our latest foreign exchange rates

Things you should know

Deposit Accounts for Personal & SMSF customers Terms and Conditions (PDF 1MB)

Westpac Debit Mastercard® Terms and Conditions (PDF 205KB)

Online Banking Terms and Conditions (PDF 417KB)

Find out what information you need to provide to become a customer (PDF 657KB)

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

1. Visit a Westpac branch when you arrive to complete your ID verification. Withdrawals cannot be made until ID verification is completed.

Read the Apple Pay Terms and Conditions (PDF 42KB) before making a decision and consider if it is right for you. To use Apple Pay you will need an eligible card and a compatible device with a supported operating system. See our Apple Pay FAQs for more information. Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

World Mastercard®, Mastercard® and the Mastercard Brand Mark are registered trademarks of, and PayPassTM is a trademark of, Mastercard International Incorporated.

© Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714.