Everyday banking and savings account

Why open a Choice everyday account and Westpac Life savings account together1?

Shop and get money out with a Debit Mastercard2

Use your Debit Mastercard2 to shop securely online, access cash at ATMs and use PayPass™ to tap and go on purchases under $100.

Be rewarded with bonus interest

Enjoy a competitive base rate on your savings and earn bonus interest each month you grow your balance3.

Maximise your savings

Got a savings goal in mind? Use the Savings Goals4 feature to set up and track your personalised goals in Online Banking.

Secure banking

We’ve got your back with 24/7 fraud monitoring and our Fraud Money Back Guarantee5.

Aged 18-29?

You could earn up to 5.20% p.a. variable interest on your first $30,000 savings with a Life Savings and Choice bank account.

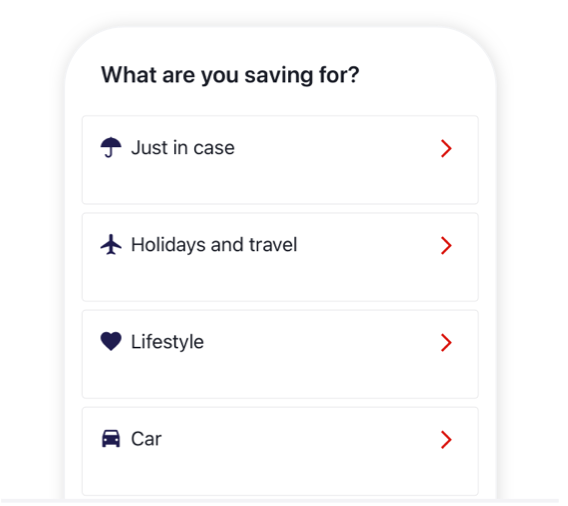

Savings Goals feature

The Westpac Life account Savings Goals4 make it easy to manage your long and short term goals within a single account.

1. Setting up your savings goals

Set up to 6 different goals in the one account! You can change the savings amount, date and category across all of your goals and adjust them at any time.

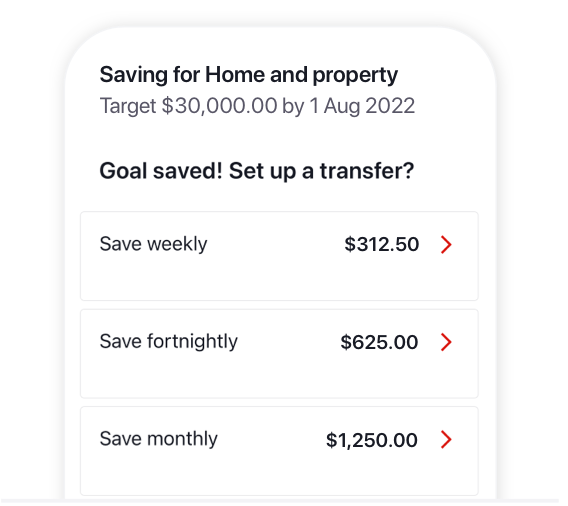

2. Adding to your savings goals

Each time you transfer money into your savings, you can distribute your amount across goals. Make it easier by setting up recurring transfers so the money automatically splits after pay day.

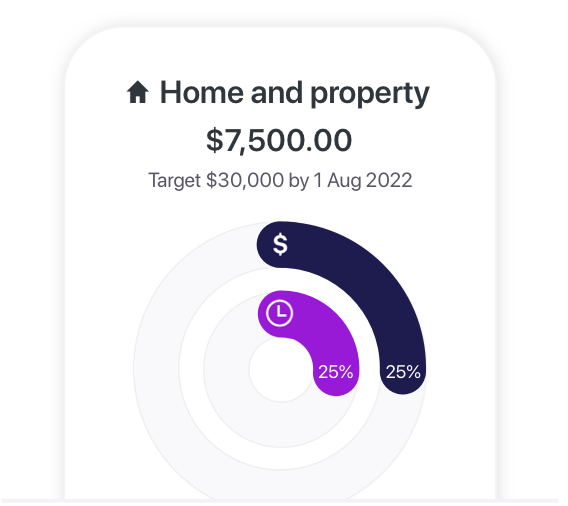

3. Tracking your progress

Tap on each of your savings goals to see how you're doing and how much you should be saving to make it in time.

.jpg)

Apple Pay is here

Apple Pay offers a fast and secure way to pay in-store and online, using your favourite Apple device.

Benefits

Choose a payment method that suits you:

- Make purchases with Google Pay™7 or Samsung Pay8 by simply tapping your mobile at contactless terminals

How to open

You can open an everyday and a savings account together through one simple form.

Open online in less than 3 minutes

You can get your ID verified instantly with your driver’s licence, Medicare Card, passport, NSW Photo Card or birth certificate (no need to visit a branch).

Activate your Online Banking in an instant

Once you’re activated you can import BPAY® billers and Payees from selected banks into your Westpac Online Banking.

We’ll verify your ID and send out your Debit Mastercard

Your ID is verified online or in branch. Once you have your card you can use it to shop online or in person worldwide using your own money.

Switch to Westpac

Once you've opened an account with us, switching your banking is now easier than ever.

Connect to your existing bank and import your payees and BPAY® billers into Westpac Internet Banking.

Interest earned on Westpac Life account only.

| Total variable interest rate | Up to 5.00% p.a. |

|---|---|

| Standard variable base rate (when no standard variable bonus rate applies) | 2.00% p.a. |

| Standard variable bonus rate | 3.00% p.a. |

How do I earn bonus interest on my Westpac Life account?

Bonus interest is payable each month that you:

- Make a deposit to the account;

- Ensure your account balance is higher at the end than the beginning; and

- Keep your account balance above $0 at all times.

A month is the period from close of business on the last business day of the previous month to close of business on the last business day of the current month.

When is interest paid to my Westpac Life account?

Interest is paid on the last business day of each calendar month. Balances in your account on and after the last business day won't be included in the interest calculation for that month but will be included in the interest calculation for the following month. Balances include deposits made to your account.

Things you should know

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

2. Debit Mastercard®: holders need to be at least 8 years of age and have an Australian residential address to be eligible for the card.

a. your account balance has not fallen below $0; and

b. you (or someone on your behalf) have made a deposit of any amount; and

c. the account balance on the last business day of the month is higher than the account balance on the last business day of the previous month.

Interest paid into your account does not qualify as a deposit in terms of bonus interest eligibility.

10. Cardless cash: is available on eligible Westpac transaction accounts with a linked debit card. Get Cash limit of 3 withdrawals per day applies, subject to $500 daily withdrawal limit and $1,000 weekly withdrawal limit. Only available at Westpac Group ATMs in Australia. To access cardless cash on your mobile you must be registered to use Westpac Online Banking and download the Westpac Mobile Banking App. To use Westpac Mobile Banking on Apple Watch you’ll need to pair your Apple Watch with an iPhone 5 or above with iOS 8.2 or above. You’ll also need the Westpac Mobile Banking app (version 6.1 or above) installed on your iPhone.

- You must be aged 18-29 with a Westpac Life and a Westpac Choice account – both in the same name. Joint accounts are not eligible.

- If you have multiple Westpac Life or Choice accounts, only the earliest opened account is eligible.

- You must make 5 eligible purchases with the debit card linked to your Westpac Choice account and have these settled (not pending) within a calendar month. The following transactions are ineligible: ATM transactions, PayID, BPAY, EFTPOS cash-out only transactions, direct debits and paying off a credit card account.

- For bonus interest qualification, a month is the period from close of business on the last business day of the prior month to close of business on the last business day of the current month. Bonus interest is calculated on the daily balance of your eligible Westpac Life account up to $30,000, and paid to your eligible Westpac Life account by the 20th day of the following month.

- If your eligible Westpac Life account is closed before 21st day of the following month, the bonus interest will not be paid.

- Only one Spend&Save bonus interest offer per customer.

- Offer may be varied or withdrawn at any time in accordance with the Deposit accounts for Personal customers Terms and Conditions. (PDF 621KB)

Read the Apple Pay Terms and Conditions (PDF 42KB) before making a decision and consider if it is right for you. To use Apple Pay you will need an eligible card and a compatible device with a supported operating system. See our Apple Pay FAQs for more information. Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Mastercard® is a registered trademark of Mastercard International Incorporated.

BPAY® and Osko® are registered trademarks of BPAY Pty Ltd ABN 69 079 137 518.

New app

New app

Classic app

Classic app