Debit Mastercard

Why Debit Mastercard?

- Shop online or in person worldwide using money from your bank account

- Use contactless payments technology to shop safely with ease and convenience

- Set up Apple Pay and Google PayTM to pay using your compatible mobile device 1

- Link up to 2 eligible Westpac bank accounts to your debit card

ATM network at home and overseas

No ATM withdrawal fee at any major bank ATM in Australia and around the world via the Global ATM Alliance and partner ATMs (other fees may apply)2

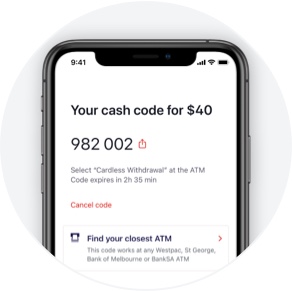

Cardless cash without ATM fees

Use cardless cash3 to withdraw cash from any in Australia without needing your debit card - using iPhone, Android and Windows Phone

Fraud Money Back Guarantee

Shop securely with your debit card. We’ve got your back with 24/7 monitoring for fraudulent transactions and our Fraud Money Back Guarantee4

Card on hold

Can’t find your debit card? Don’t worry – with Card on Hold, in seconds you can temporarily lock it while you search5

Aged 18-29?

You could earn up to 5.20% p.a. variable interest on your first $30,000 savings with a Life Savings and Choice bank account.

Added security

With Westpac’s Added Online Security Service, from time to time you will need to enter a unique ‘One Time Password’. You will receive your unique password via SMS or email6, when purchasing online with participating retailers who have been verified by Mastercard®.

Which Westpac accounts are eligible?

Your Westpac Debit Mastercard®can be linked to up to 2 of these transaction accounts. Choose the account that matches your circumstances to find out more:

Eligibility criteria apply to these accounts.

Who can apply for a Debit Mastercard?

For Choice youth account, the eligible card age is 8. For any other transaction account, the eligible card age is 14. You must have an Australian residential address.

Give them a head start with their own Debit Card

Children 8 years old and over can link a Debit Mastercard® to their Westpac Choice everyday account, fast-tracking their money skills with kid-friendly features, keeping them safe and secure:

Weekly spend limit

So they don't spend all their money at once, changing the limit as they get more experienced.

Card lock and unlock

Keeps their money safe if they’ve lost, misplaced or had their Debit Card stolen.

Kid rated shopping

Children can shop confidently in-store or online without the fear of spending at adult-only sites or retailers.

Parental notifications

Messages for parents or guardians about their account activity so you can guide and support your child.

What’s the difference between debit cards and credit cards?

Both debit cards and credit cards can be used for instore and online purchases and setting up direct debits, but the way they work is different. When you use a debit card, you’re spending money that’s in your linked bank account.

Are debit cards free?

There’s no annual card fee for your Debit Mastercard, however account keeping fees may apply. Westpac does not charge fees for domestic purchases and withdrawals at participating ATMs. Cash withdrawals are free at ATMs around the world via the Global ATM Alliance and partner ATMs, though foreign transactions fees will apply.

Priceless Sydney

Introducing Priceless Sydney, a unique collection of experiences curated exclusively for Mastercard cardholders. From dining, shopping and sporting opportunities to exciting hotel and entertainment offers, the best of Sydney is waiting at www.priceless.com.

Other accounts for

Feature articles

More options

Things you should know

Deposit Accounts for Personal & SMSF customers Terms and Conditions (PDF 621KB)

Westpac Debit Mastercard® Terms and Conditions (PDF 204KB)

Online Banking Terms and Conditions (PDF 417KB)

Find out what information you need to provide to become a customer (PDF 657KB)

Read the terms and conditions at westpac.com.au before making a decision and consider whether this product is appropriate for you.

1. Apple Pay and Google Pay: Read the Apple Pay Terms and Conditions (PDF 42KB) or the Google Pay Terms and Conditions (PDF 125KB) before making a decision and consider if it is right for you. To use Apple Pay or Google Pay you will need an eligible card, and a compatible device with a supported operating system.

3. Cardless cash: Get Cash is available on eligible Westpac transaction accounts with a linked debit card. Get Cash limit of 3 withdrawals per day applies, subject to $500 daily withdrawal limit and $1,000 weekly withdrawal limit. Only available at Westpac ATMs in Australia. To access cardless cash on your mobile you must be registered to use Westpac Online Banking and download the Westpac Mobile Banking App. You’ll also need the Westpac Mobile Banking app (version 6.1 or above) installed on your iPhone.

4. Westpac Fraud Money Back Guarantee: ensures that customers will be reimbursed for any unauthorised transactions, provided that the customer has not contributed to the loss and contacted Westpac promptly. Refer to the Westpac Debit Mastercard Terms and Conditions for full details, including when a customer will be liable.

5. Card on hold: Available on personal credit and Mastercard® debit cards only. Cards to which a temporary lock can be applied will be listed when you sign into Mobile Banking or Online Banking and visit Lock a card temporarily under Cards services.

6. If you don't provide us with a correct mobile number or email address, you may not be able to proceed with your online transaction at participating online retailers.

Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. Android, Google Pay and Google Play are trademarks of Google Inc. World Mastercard®, Mastercard® and the Mastercard brand mark are registered trademarks, and PayPass is a trademark of Mastercard International Incorporated.