Important notice for Westpac business customers

For business customers with business finance agreements that include one or more of the following business facility types:

- Any Bank Bill Business Loan (including Fixed, Variable or with redraw);

- Any Agri Finance Loan (including Fixed, Variable or with redraw);

- Any Commercial Bill Line;

- Westpac Business One Loan;

- Negotiations Under Export Documentary Collections/Not under Documentary Credits – Remittance Document against acceptance/payment with a base rate specified as the Bank Bill Swap Yield (BBSY); and

- Westpac Trade Finance – Exports or Imports with a base rate specified as BBSY.

Over recent years, markets have faced an unprecedented period of low and negative interest rates across global markets. Now with historically low interest rates in Australia, and the potential for further reductions, the issue of negative interest rates requires consideration by our business customers.

Recent market developments have increased the focus on zero interest rate floors in loan contracts– being a provision that states if the external reference rate (BBSY) falls below zero on any given rate reset/rollover date, then the interest rate in the document for that interest period is deemed to be zero.

On 24 March 2020, we published these important notices (PDF 95KB) in ‘The Australian’ and ‘The Australian Financial Review.’

What does this notice mean for you?

If your facility has been documented on a newer ‘Business Finance Agreement’, it will already contain a zero rate floor for BBSY and there is no change for you.

However, for older ’Business Finance Agreements’, there are some examples below of how a negative BBSY rate would function once this change becomes effective on 23 April 2020. The examples below are general in nature and you should always refer to your specific documentation. You should seek your own independent legal, accounting, tax and other financial advice.

Example 1: Commercial Bill Line

Variable Rate - if BBSY rates are negative at the next bill rollover date, or on the date of drawing of a new bill:

- If your yield is BBSY, then a zero rate floor will apply. Your discount rate would be 0% p.a. if BBSY was negative.

- There is no change to the calculation of your acceptance fee or line fee.

Fixed Rate:

There is no impact to a facility during a fixed rate period. Once the fixed rate period ends, the zero rate floor will apply as outlined above.

Example 2: Bank Bill Business Loan

Variable Rate - if BBSY rates are -0.10% at the next rate reset date, or on the date of drawing of a new facility:

| Rate (% p.a.) | |

|---|---|

| BBSY | -0.10% |

| Base Rate (with a zero rate floor) | 0.00% |

| Business Loan Margin + Risk Margin | 2.50% |

| Total interest rate | 2.50% |

Fixed Rate:

There is no impact to a facility during a fixed rate period. Once the fixed rate period ends, the zero rate floor will apply as outlined above.

Example 3: Rebate Fixed Rate Bank Bill Business Loan

As there is no impact to a facility during a fixed period, the payment of the rebate is unaffected if BBSY goes below zero.

E.g. You have a facility with a fixed rate of 2.50% p.a. and a Rebate Reference Rate of 1.00% p.a, and BBSY is -0.10%.

| Reference Rate | Rate (% p.a.) |

|---|---|

| Fixed Rate | 2.50% |

| Variable Reference Rate – taken to be BBSY | -0.10% |

| Rebate Reference Rate | 1.00% |

| Rebate that applies | 1.10% |

| Effective Rate | 1.40% |

Example 4: standalone derivatives (such as an interest rate swap)

If you have a standalone derivative (such as an interest rate swap), you should contact your Financial Markets specialist to understand whether your facility has a zero rate floor, or if you need to consider changes to your hedge.

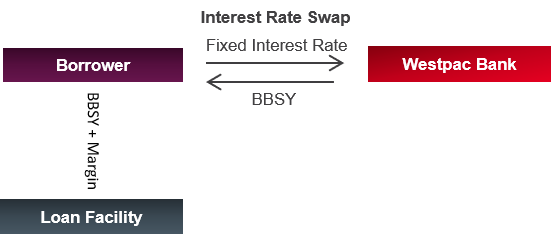

Rate environment with positive rates:

If BBSY (floating rates) are above zero, a hedger with an IRS will be paying:

- The value of BBSY on the variable loan facility; and

- The value of the fixed rate leg of the IRS contract.

A hedger will be receiving:

- The value of the BBSY leg of the IRS contract.

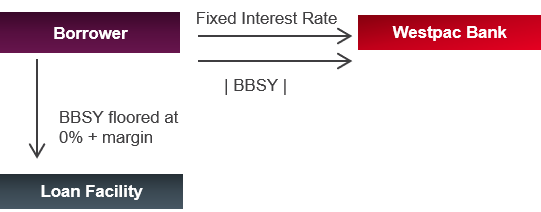

Negative rate environment where there is a zero rate floor in the loan contract but not in the IRS:

If BBSY (floating rates) are negative, a hedger with an IRS without a zero rate floor clause will pay:

- The value of the fixed rate leg of the IRS contract; and

- The value of the absolute BBSY leg of the IRS.

Is there anything you need to do?

No, the above changes will automatically take effect from 23 April 2020 and the remainder of your finance agreement remains unchanged.

We’re here to help

If you have any concerns or questions about this change, please contact your Relationship Manager or Financial Markets specialist.

Things you should know

This communication has been prepared without taking account of your particular financial situation, needs or objectives and is not to be construed as financial advice. Westpac strongly recommends that you seek appropriate independent accounting, tax, financial and legal advice before acting on this information.