Everyday bank account for new arrivals

Why Westpac Choice?

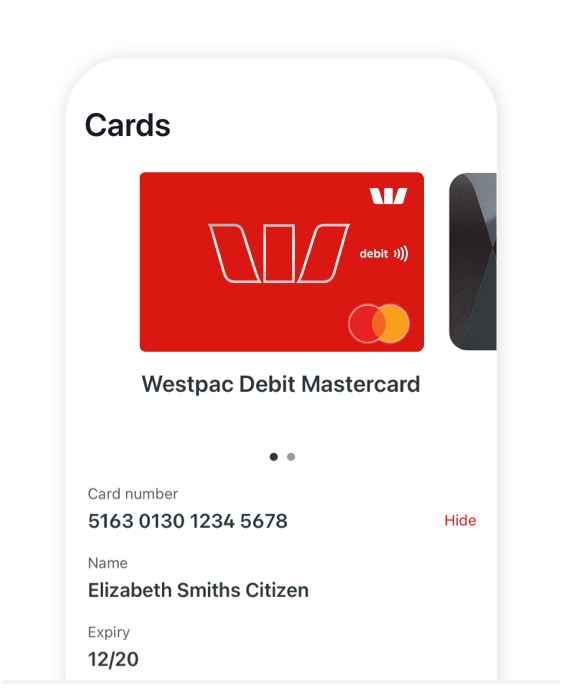

Instant Digital Card®

Get instant access to a digital version of your card¹ via the Westpac App before your Debit Mastercard®2 arrives in the mail

Pay $0 monthly fee

Pay no account-keeping fee for your first year if you've arrived in Australia within the last 12 months. After this, we will continue to waive the fee if you meet certain criteria outlined in the ‘fees’ section below

$0 international transfers5

When you send foreign currency overseas via Online Banking or the Westpac App. See our conversion rates and included countries.

Get exclusive offers

Get access to discounts and cashbacks just for being a customer, including exclusive ShopBack offers

Account Features

Access cash via the app

Get cash out of Westpac, St.George, Bank of Melbourne and BankSA ATMs without a card using the Westpac App.

Apple and Google Pay

Link your card to Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay to make fast contactless payments with your mobile or wearable.3

Simple and Secure

Now you can sign into the Westpac App, safely and securely using facial recognition, your fingerprint or 4-digit passcode.4

ATM network at home and overseas

Pay no ATM withdrawal fee at Westpac Group ATMs in Australia, and overseas through our Global ATM Alliance. Other fees may apply.8

Pay and get paid in seconds

Use PayID to get paid instantly by your friends and family with just your mobile number. You can also tap and go using your mobile or your Debit Mastercard.

Link your Choice account with a Westpac eSaver savings account

Enjoy a sweet, total introductory interest rate of up to 5.20% p.a on your savings for the first 5 months, giving you the breathing space to explore your new life in Australia.

Setting up life in Australia?

We've partnered with ShopBack to bring you Cashback offers on a wide variety of online stores across homewares, technology, food services, travel and more to make it easier for you to settle in.

Fees

| Standard fees (fees may change) | Amount |

|---|---|

|

Pay no Account-Keeping Fee for the first 12 months (usually $5). After this, the fee will continue to be waived for:

|

$0 |

Other fees and charges may apply. Please refer to the Terms and Conditions (PDF 1MB)

Security

Card on hold

Can’t find your card? Don’t panic, you can temporarily lock it in seconds with Card on Hold while you search6.

Fraud Money Back Guarantee

Shop securely with your debit card. We’ve got your back with 24/7 fraud monitoring and our Fraud Money Back Guarantee7.

Westpac Protect™ SMS Code

Increase your security when banking online by using your mobile phone to confirm certain transactions via text messages.

Safe Online Banking guarantee

If your Westpac account is compromised as a result of Internet fraud, we guarantee to repay any missing funds, providing you comply with our Online Banking Terms and Conditions.

Other accounts for

Related articles

More options

Things you should know

Westpac Debit Mastercard® Terms and Conditions (PDF 205KB)

Online Banking Terms and Conditions (PDF 417KB)

Find out what information you need to provide to become a customer (PDF 657KB)

Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. Fees and charges apply and may change.

1. The Digital Card: The Digital Card is only available on the Westpac App and supported with the latest version of Westpac Mobile Banking. The terms and conditions applicable to your product also apply to the use of your digital card. Online Banking Terms & Conditions also apply. You may not always be able to access your digital card.

2. Debit Mastercard®: holders need to be at least 8 years of age and have an Australian residential address to be eligible for the card.

3. Google Pay: Read the Terms and Conditions (PDF 125KB) (PDF 125KB) before making a decision and consider if it is right for you. Available for eligible cards. To use Google Pay you will need to use a compatible device with a supported operating system.

4. Finger print login: Fingerprint sign in is available on compatible devices only. Customers must be registered for Westpac online banking and have set up fingerprint ID to use the service.

5. Westpac transfer fees still apply for funds sent in Australian dollars. Receiving bank fees may also apply, check the currency converter for indicative rates and fees

6. Card on hold: Available on personal credit and Mastercard® debit cards only. Cards to which a temporary lock can be applied will be listed when you sign in to Mobile Banking or Online Banking and visit Lock a card temporarily under Cards services.

7. Westpac Fraud Money Back Guarantee: Customers will be reimbursed for any unauthorised transactions provided that the customer has not contributed to the loss and contacted Westpac promptly.

Read the Apple Pay Terms and Conditions (PDF 42KB) before making a decision and consider if it is right for you. To use Apple Pay you will need an eligible card and a compatible device with a supported operating system. See our Apple Pay FAQs for more information. Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Mastercard® is a registered trademark of Mastercard International Incorporated.