Travel money card

A smart and safe way to pay in foreign currencies

Features and benefits

- Travel and shop worry-free

Lock in your budget by converting your loaded AUD ahead of time and feel safe and secure from fraudulent transactions with Mastercard Zero Liability protection.¹

- Lounge access if your flight is delayed

You and a companion can get access to over 1,000 lounges² if your flight is delayed for 120 minutes or more. Visit the Mastercard Flight Delay Pass website to pre-register your flight. T&Cs apply.

- Convenient options for you

Pick up cards from any branch and activate them online, or order online from home and receive your cards in 5-8 business days.

- Access unforgettable experiences and rewards

Your Mastercard gives you access to Priceless® Cities with unforgettable experiences in the cities where you live and travel.³ You can also get cashback when you shop overseas with your Worldwide Wallet, thanks to Mastercard Travel Rewards.⁴

How it works

Save on fees

- Avoid ATM withdrawal fees

Through our Global ATM Alliance and overseas partner ATMs which you can easily find using the ATM locator in the Westpac App

- No foreign transaction fees

Avoid a 3% foreign transaction fee whenever you use your Worldwide Wallet to shop online or in person.

- No load or unload fees

Reload your account on the go, whenever you need.

- No account keeping fees

You won’t pay any inactivity or account keeping fees, so any funds left in your account will be there ready for your next trip or purchase.

Other fees may apply. Read the Product Disclosure Statement (PDF 307KB) for full list of fees.

Like to shop online?

Use your Worldwide Wallet for online purchases in foreign currencies and avoid a 3% foreign transaction fee.

You can also shop worry-free from fraudulent transactions with Mastercard Zero Liability protection.1

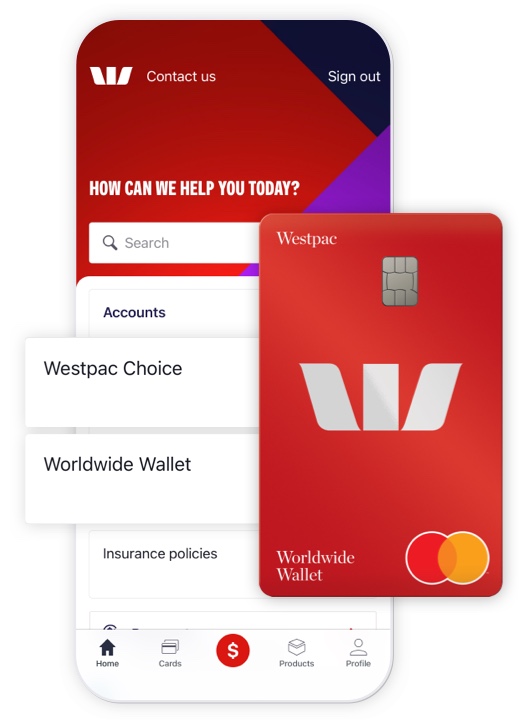

Complete visibility and control

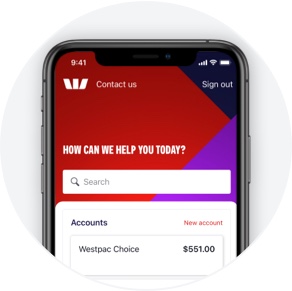

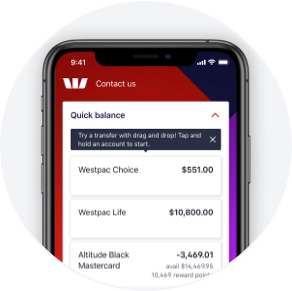

All in one view

See your account balance and transactions in the Westpac App or in Online Banking.

Move money easily

Transfer money to and from your Worldwide Wallet and convert AUD into foreign currencies while you’re on the go in the Westpac App.

More ways to pay

Add your Worldwide Wallet to Google Pay™ or Samsung Pay™, or use your card to tap and go.

A spare card for peace of mind

Both cards give you access to the same funds and can be locked and unlocked instantly at your convenience via Online Banking or the Westpac App.6

Add up to 11 currencies

Lock in your rate head of time by converting currency in advance.

You'll still be able to spend in currencies not listed here and avoid Westpac's 3% foreign transaction fee.

To view our latest rates, see our currency converter.

| Available currencies | |||

|---|---|---|---|

|

AUD - Australian Dollar |  |

USD - United States Dollar |

|

EUR - Euro |  |

GBP - British Pound |

|

NZD - New Zealand Dollar |  |

CAD - Canadian Dollar |

|

JPY - Japanese Yen |  |

THB - Thai Baht |

|

ZAR - South African Rand |  |

SGD - Singapore Dollar |

|

HKD - Hong Kong Dollar | ||

Order online or pick up in branch

Order online

You can open your travel money card account online and we’ll mail your cards to your address in 5-8 business days.

or

Pick up in branch

If you need your cards within 8 business days its best to pick them up in branch and activate them online.

Already have your cards?

Activate now

FAQs

A Westpac Worldwide Wallet is a prepaid travel money card that can help you save on foreign transaction fees and give you control over your spending. With the Westpac Worldwide Wallet, there are no load, reload or unload fees, or ATM withdrawal fees at Westpac Group or select Westpac Group partner ATMs in Australia and Global ATM Alliance partners.5

Before you shop or travel, you can also choose to convert your loaded AUD into any of the following currencies: USD, EUR, GBP, CAD, JPY, THB, ZAR, SGD, NZD and HKD. By locking in your exchange rate in advance and knowing exactly how much of a foreign currency is loaded on your card, the Westpac Worldwide Wallet can make it easy for you to stay on top of your spending. When you sign up to a Westpac Worldwide Wallet, you’ll also get access to exciting Mastercard travel and shopping perks - Flight Delay Pass, Mastercard Travel Rewards and Priceless Cities.

Things you should know

Westpac Retail and Business Banking Financial Services Guide and Credit Guide (PDF 238KB)

A target market determination has been made for this product. Please visit westpac.com.au/tmd for the target market determination.

Information will be disclosed to third parties about you and your Product, or transactions made by you with the Product, as necessary for the service provision or as required by law. Westpac’s Privacy Statement explains our commitment to the protection of your personal information or you can learn more by calling 132 032.