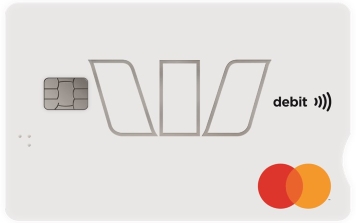

Business Debit Mastercard

What are the benefits of a Business Debit Mastercard®?

- Use a debit card linked to your business bank account to deposit and withdraw funds and make payments and purchases

- Pay anywhere worldwide – wherever Mastercard is accepted

- Withdraw business cash worldwide – No overseas withdrawal fee around the world via the Global ATM Alliance and partner ATMs (other fees may apply) 1

- No annual card fee – other fees and charges may apply

- Fraud detection – 24/7 transaction monitoring for irregular or suspicious activity, for your protection and peace of mind

- Contactless tap and go – to speed up business purchases under $100

- Lock your card - avoid the hassle of immediately cancelling a mislaid card by putting a temporary block on it via Online Banking or the Westpac App. 2

What business bank accounts are eligible for the Business Debit Mastercard?

Your Business Debit Mastercard can be linked to up to two of these Westpac business bank accounts:

- Business One (Choose this account if you bank online and on mobile)

- Business One Plus (Choose this account if you bank online, on mobile and occasionally in branch)

- Community Solutions One (if you are a not-for-profit organisation)

What else does the Business Debit Mastercard offer?

Versatility

Provide employees with full or limited access cards to your business account.

Visibility

View individual cardholder transactions (identifiable by card number) on a single bank statement.

Security

The Westpac Fraud Money Back Guarantee ensures that any unauthorised transaction claims will be reimbursed provided the cardholder has not contributed to the loss and has contacted us promptly. See our Terms and Conditions (PDF 145KB) (PDF 205KB) for full details of cardholder liability.

Will I be charged fees for this debit card?

There is no annual fee for using the Business Debit Mastercard. Other fees and charges may apply.

All transactions made using a Business Debit Mastercard (including transactions using the ‘credit’ button on an EFTPOS terminal) will be counted towards the monthly transaction allowance/limit that may apply to the deposit account(s) linked to the card. See the Terms and Conditions below for more details.

How do I activate my debit card?

You can activate your debit card over the phone or online (if you have personal Online Banking). For more information on getting started, check out our guide to activating your Westpac Business Debit Mastercard.

Am I eligible?

- 18+ years old (applicant plus all signatories)

- Account holder, signatory, or nominated by the account holder to receive a card

- Operating in Australia with an Australian address

- Needs an eligible business account in the name of the account holder, to link the card.

Things you should know

Business Debit Mastercard® Terms and Conditions (PDF 205KB)

Deposit Accounts for Business Customers Terms and Conditions (PDF 556KB)

Westpac Business Debit MasterCard Application (PDF 1MB)

Westpac Business Debit MasterCard Application - Maintenance Form (PDF 1MB)

24/7 access is subject to system availability.

Fees, charges, terms and conditions apply. Talk to your banker for product details.

1. A 3% Westpac Foreign Transaction Fee applies to overseas debit or credit card withdrawals. A 2% cash advance fee applies to credit card withdrawals where the "Credit" option is selected. A list of Global Alliance members is available.

2. Card Lock will temporarily stop new transactions on your card for up to 15 days or until reactivated. The card will reactivate after 15 days if you do not cancel the card. Cards to which a temporary lock can be applied will be listed when you sign in to Mobile Banking or Online Banking and visit Lock a card temporarily under Cards services.

Find out what information you need to provide to become a customer.

World Mastercard®, Mastercard® and the Mastercard brand mark are registered trademarks, and PayPass is a trademark of Mastercard International Incorporated.